Shutdown stalemate and the Fed's next move

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The prolonged shutdown adds another layer of economic uncertainty

- With limited data, Powell’s press conference will be even more important

- Busiest week of earnings season ahead − with major tech earnings on deck

Welcome to the Sports Equinox! If you’re not familiar with the term, it refers to that unique time in late October when all four major U.S. sports leagues − baseball, football, basketball and hockey − are in action on the same day. It’s a rare and exciting moment for sports fans, offering the chance to flip between championship-level baseball, a football season already in full swing and early-season basketball and hockey games. This convergence creates a thrilling, unpredictable day for sports enthusiasts packed with drama. Interestingly, the financial markets are gearing up for their own version of a 'Sports Equinox' week. Just as fans juggle overlapping games on October 27, investors will face a crowded calendar of potentially market-moving events that have our attention. Below, we outline the key developments we’re watching next week − events that could provide valuable insight into the direction of the economy and financial markets:

- Politicians ‘Running Out The Clock’ On The Shutdown | The government shutdown has now stretched into its 24th day, making it the second-longest in history. Despite repeated attempts to break the deadlock, the Senate remains at an impasse, with all 12 attempts to pass a resolution falling short of the 60-vote threshold. If the shutdown extends into November − as the betting markets suggest − it will surpass the record 34-day shutdown that occurred in 2018-19 during President Trump’s first term. Historically, these standoffs tend to end once the impact is felt by the public (e.g., flight delays) and pressure on lawmakers intensifies. So far, the effects have been relatively mild, but that may change soon. Upcoming delays in paychecks for military and civilian federal workers, health insurance premium hike notices expected on November 1, and disruptions to SNAP benefits could significantly raise the stakes. In the meantime, the prolonged shutdown adds another layer of uncertainty to the economy and could deepen the slowdown already evident in the fourth quarter.

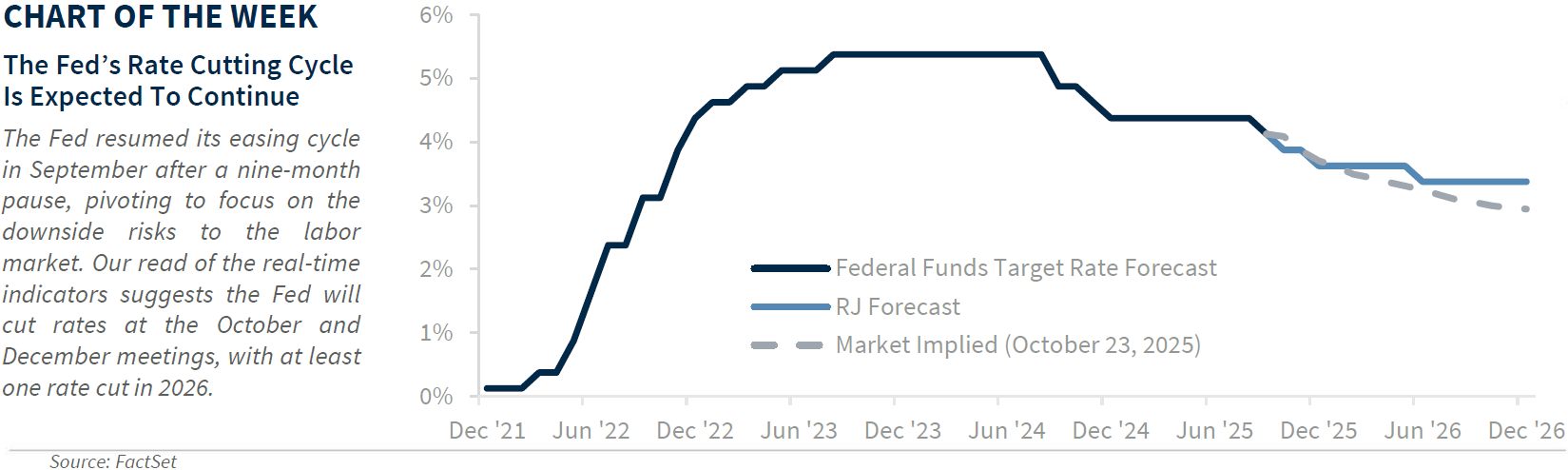

- Fed ‘Officials’ Widely Expected To Deliver Another Rate Cut | The recent government shutdown has left a gap in official economic data, but that’s unlikely to change the outcome of next week’s Fed meeting. A 25 bp rate cut is still widely expected, as recent Fed commentary has leaned toward more easing − though with caution. Chair Powell even noted that little has changed since September, signaling a green light for a cut and hinting that the end of quantitative tightening (reducing the assets on the Fed’s balance sheet) may be near. With limited data, Chair Powell’s post-meeting press conference will carry outsized importance. Expect him to explain the Fed’s focus on managing labor market risks, while acknowledging the challenge of making future decisions without the usual flow of economic reports. Our read of real-time indicators suggests more cuts are likely (one more this year alone in December), though not as aggressive as the five cuts currently priced in through 2026. And keep an eye on a potential wildcard: the next Fed Chair could be announced by December.

- Major Tech Earnings ‘On Deck’ | Next week marks the busiest week of earnings season, with nearly half of the S&P 500’s market cap and 182 companies reporting. So far, Q3 results are off to a good start − S&P 500 earnings are up ~9% YoY, marking the ninth straight quarter of growth, the longest streak since 2018. Plus, 82% of companies are beating EPS estimates − the best showing since 3Q23. Tech is leading the charge. Reports from Meta, Microsoft, Google, Apple and Amazon will be closely watched as investors look for clues on capex trends and whether earnings momentum can keep up. Thanks to AI-driven growth, our MAGMAN* group (mega-cap tech-related names) is expected, based on analyst consensus estimates, to post EPS growth of ~17% YoY − far outpacing the broader index at ~5%. This leadership is why Tech remains one of our favored sectors, while we note individual company results may vary. But the story doesn’t end there. With more Fed rate cuts and tailwinds from the new tax law, we expect earnings growth to broaden beyond Tech − moving from ~7% in 2025 to ~12% in 2026 for the rest of the index − supporting our optimistic 12-month view for the equity market.

- Trump-President Xi ‘Power Play’ Ahead Of The APEC Meeting | The White House has confirmed that President Trump and Chinese President Xi Jinping will meet on October 30, ahead of the APEC summit in South Korea. In the lead-up, both countries have taken steps − both in words and actions − that have escalated trade tensions. Recent moves include reciprocal docking fees on each other’s ships, China tightening restrictions on rare earth exports and launching an investigation into a US chipmaker, and the White House threatening to raise tariffs on Chinese goods from 30% to 130%. Much of this appears to be posturing in the run-up to the November 10 deadline. Neither side wants to look weak, but neither wants a repeat of the turmoil earlier in the year. While it’s unrealistic to expect the Trump-Xi meeting to resolve all issues, even a shift toward calmer rhetoric could help move negotiations forward. Two key things to watch: 1. Will Trump walk back his 130% tariff threat? 2. Will China recommit to a steady supply of rare earth exports and agricultural purchases, such as soybeans?

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.